Stock Market Analysis: Trending Stocks of October

5 minutes for reading

Today, we will take a look at the stocks of the leading companies in the number of Google Trends search requests made to Google in October. The top-5 list of the most trending companies includes Alphabet Inc., Netflix Inc., Carnival Corporation, Twitter Inc., and Apple Inc. Let's find out which fundamental and economic factors influenced the popularity of these companies.

1. Alphabet missed both revenue and earnings in Q3

In October, tech giant Alphabet Inc., which owns Google and YouTube, attracted lots of attention with its weak financial report for Q3, 2022.

According to the report, the net profit of Alphabet Inc. in July-September, compared to the results of the same months last year, dropped by 26.5% to $13.91 billion, while EPS fell 24.3% to $1.06. Revenue demonstrated a very modest growth of 6.1% to $69.1 billion.

The decline of the international ads market made sales of YouTube digital commercials drop by 1.9% to $7.1 billion, while the revenue of Google Search recorded a modest 4.3% growth to $39.5 billion.

Since the beginning of 2022, the shares of Alphabet Inc. (NASDAQ:GOOG) have lost almost 34%.

In October, the stock quotes attempted a partial recovery, only to drop by 9.63% to $94.82 after the financial report was published on 26 October. It is still unclear how Alphabet Inc. will manage to retain the trust of its investors and bring its share price back to the levels of the beginning of 2022.

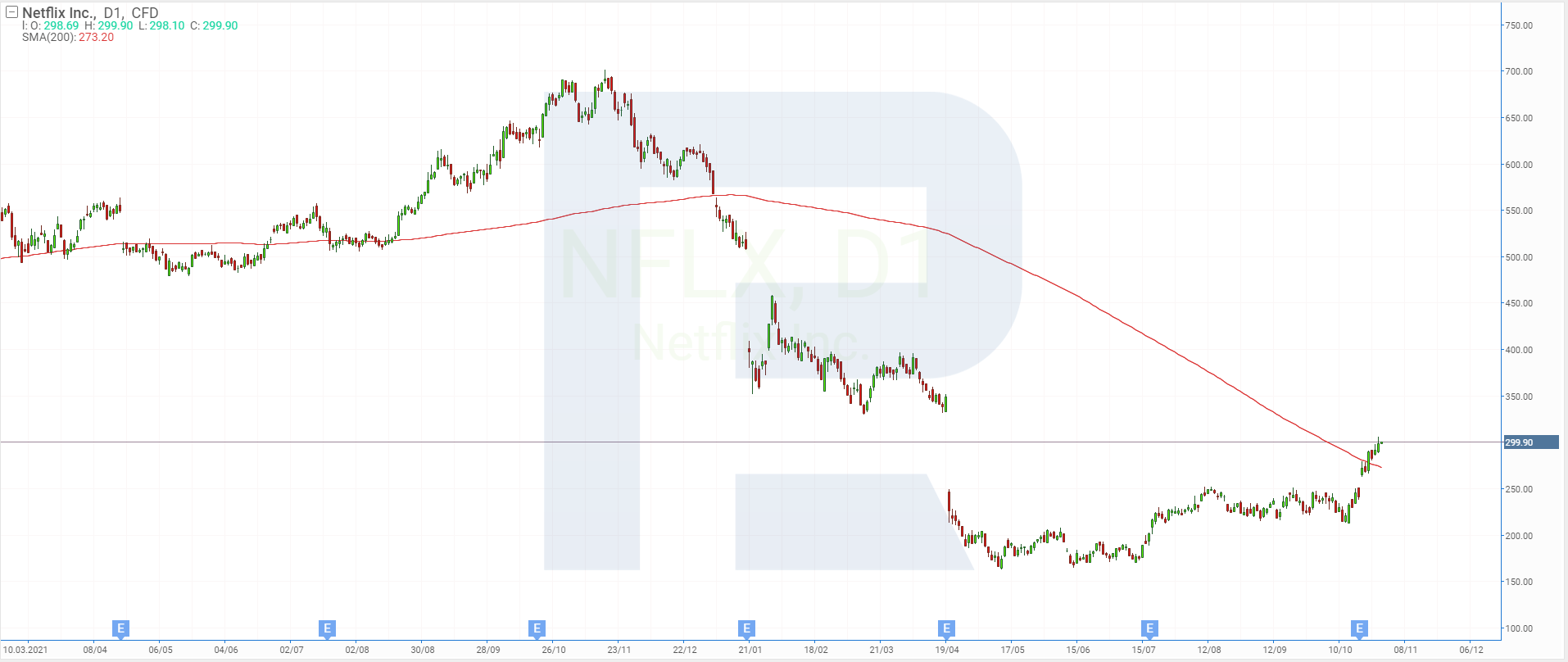

2. Netflix: strong report and new commission fees

Netflix Inc., owning the world’s largest streaming service, decided to cut down on its spending and monetise the joint use of accounts, i.e., charge user fees for exchanging passwords. This has already been done in Peru and Chile, and new commissions will be introduced in other countries in 2023.

Moreover, on 18 October, Netflix Inc. published its performance for Q3, 2022, reporting a 5.9% growth in revenue to $7.93 billion, and an increase in the number of subscribers by 2.4 million.

The share price of Netflix Inc. (NASDAQ:NFLX) reached a plateau at the beginning of this year after crashing previously, thereafter remaining within the range of $165-250 for several months. After the quarterly report was published, the shares began recovery and headed upwards, breaking through $250. Over ten trading sessions, the growth amounted to more than 36%. When this article was being prepared, the shares were testing $300.

3. Will Carnival return to the pre-pandemic level?

One of the world’s largest tourist cruise companies, Carnival Corporation, which boasts a fleet of 92 vessels and 150,000 employees, was seriously compromised by the COVID-19 pandemic.

However, by publishing the quarterly report for Q3, 2022, Carnival Corporation gave investors some hope. Revenue amounted to $4.3 billion, while a year ago it was $546 million. The net loss dropped by $2.8 billion.

The shares of Carnival Corporation (NYSE:CCL) lost 38% from 1 January to 26 October. Starting on 11 October, the quotes started going up and when the article was being prepared, they had already reached $8.7, growing by 40.1%.

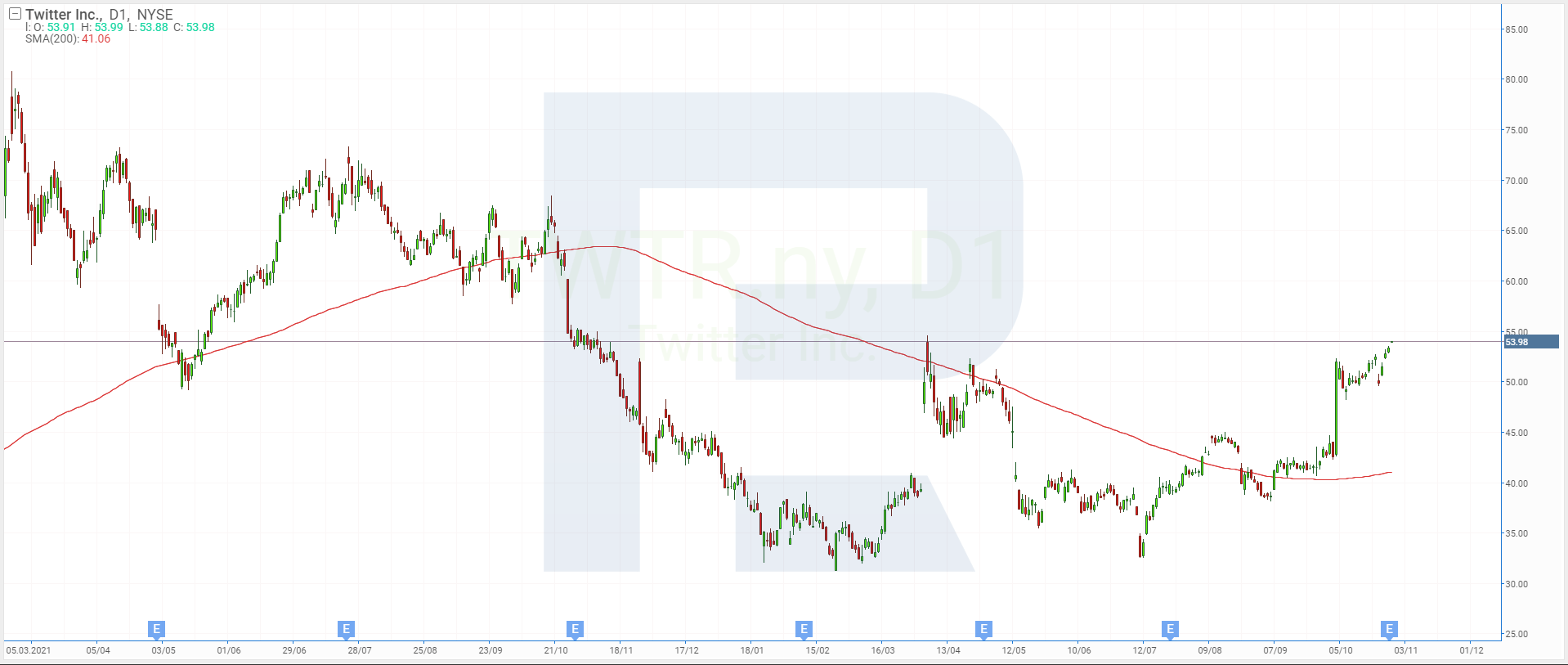

4. Elon Musk did buy Twitter

For several weeks, the news about Twitter Inc. has been in strong connection with Elon Musk and the long story of his purchase of this social network. The agreement for $44 billion excites many market players.

On 27 October, X Holdings II Inc. which belongs to Elon Musk bought Twitter Inc. According to the New York Times, the new owner of the company considers the staff inflated, and plans to reduce the number of employees by at least 50% in the nearest future.

Over October, the share price of Twitter Inc. (NYSE:TWTR) saw a 22.5% rise from $43.84 to $53.7. The quotes almost reached their April highs, but after the agreement was signed, trades in the shares of the company stopped.

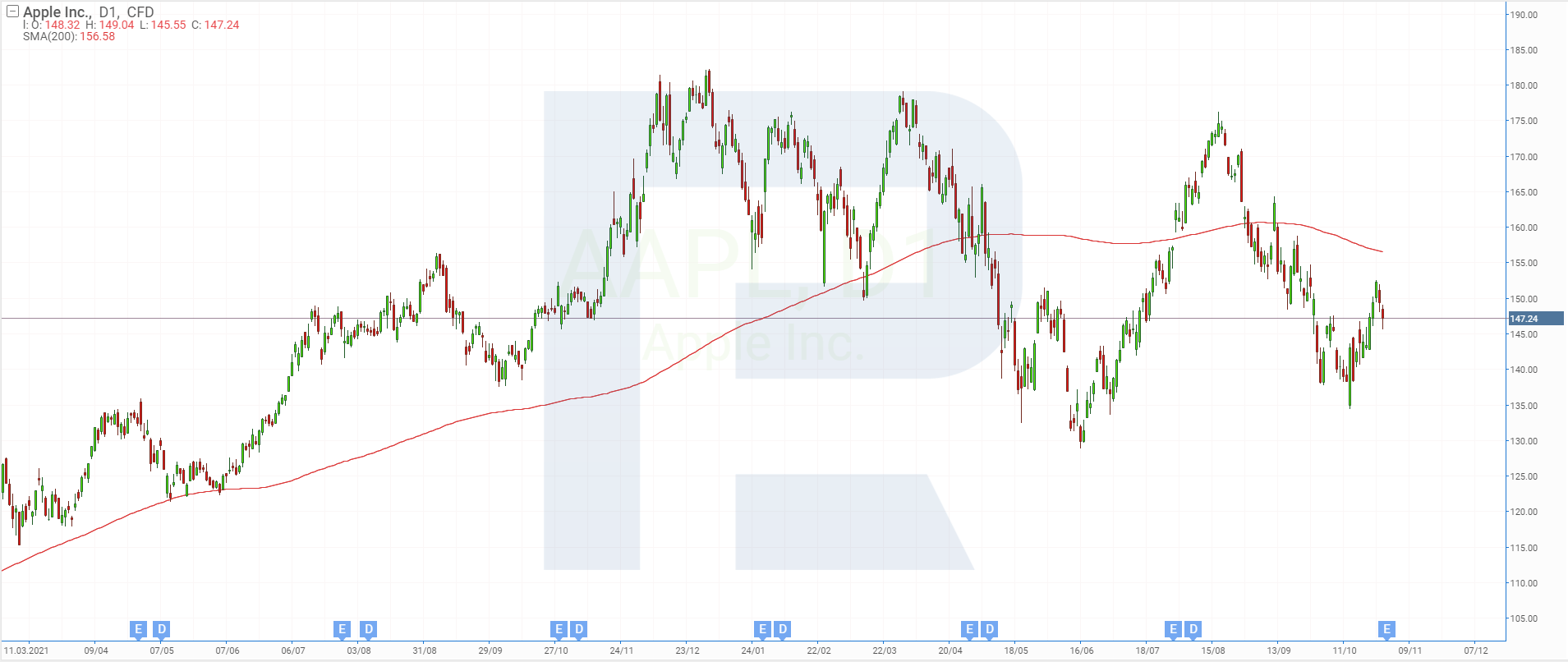

5. What happens to Apple in the nearest future?

Apple Inc. which produces hardware, smartphones, tablets, accessories, and software, keeps facing persecution and limitations from regulators in various countries.

For example, on 4 October, the EU authorities approved a draft bill that will make all manufacturers of smartphones and laptops switch to a unified type of charger – the USB Type C. Moreover, the tech giant faces more and more criticism concerning the 30-percent commission fees for App Store developers.

The share price of Apple Inc. (NASDAQ:AAPL) is prone to increased volatility. Over the past month, it survived a serious crash, which it is now trying to recover from. The decline was due to the decision against increasing the production of the iPhone 14 this year due to the low demand. This news brought the share price of Apple Inc. shares down by 8.9% from $151.76 to $138.2. When this article was being prepared, the quotes were forming a correctional wave towards $152.

Summary

In October, the most popular queries in Google Trends were in connection to Alphabet Inc., Netflix Inc., Carnival Corporation, Twitter Inc., and Apple Inc. However, being trendy is quite ambiguous.

As a rule, the popularity of these companies can be explained by the news, which was both positive and negative. Hence, investing decisions must be well-weighted and never based solely on popularity.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high