Stocks Most Bought by Hedge Funds in Q4 2022

6 minutes for reading

Hedge funds are among the largest players in the market. In today’s article, we will look at the stocks in which they invested the most money during the fourth quarter of last year. According to HedgeFollow which tracks the activity of more than 10,000 hedge funds, the Top 3 list for the largest investments in Q4 features the stocks of Microsoft Corporation, Apple Inc., and Amazon.com Inc.

1. Microsoft – 58.9 billion USD

Microsoft Corporation (NASDAQ:MSFT) is a large US tech company known for its Windows software, Windows Office, and two browsers – Internet Explorer and Edge.

In the last quarter of 2022, hedge funds invested 58.9 billion USD in Microsoft stock. The largest investors were:

- Norges Bank, the Central Bank of Norway, added some 86.3 million Microsoft shares to its portfolio for 20.7 billion USD, which makes 4.99% of the portfolio

- Morgan Stanley (NYSE:MS) raised the amount of the IT giant’s stock in its portfolio from 104 million to 119 million by investing 3.4 billion USD from October to December. The share of Microsoft stock in the portfolio is now 3.3%

- BlackRock Inc. (NYSE:BLK) bought 13.2 million Microsoft shares for 3.12 billion USD) in Q4 2022, thereby increasing their number to 532 million securities and their equivalent share in the portfolio to 4%

In Q3, Microsoft’s stock demonstrated mixed dynamics. In the beginning, the price dropped to 213 USD, then grew to 263 USD, and by the end of the reporting period it returned to the level of October – 238 USD. As a result, the stock price only recorded a 1.9% growth over three months. This can be explained by the large sales of stock: During the specified quarter, hedge funds sold company stock for 41.7 billion USD.

2. Apple – 55.5 billion USD

Apple Inc. (NASDAQ:AAPL) is a US company that develops, produces, and sells smartphones, tablets, laptops, PCs, earphones, and other accessories, as well as software.

In the period from October to December 2022, hedge funds invested 55.5 billion USD in Apple stock. The largest investors were:

- Norges Bank: the bank bought 167.3 million of the tech corporation’s shares for a total of 21.7 billion USD, which amounts to 5.2% of the bank’s portfolio

- Morgan Stanley: the firm increased the number of Apple shares in its portfolio to 208.6 million securities, which makes 3.1% of the portfolio. The sum of the investment is 3.4 billion USD

- Barclays PLC (NYSE:BCS): the bank increased the number of Apple shares in the portfolio from 1.8 million to 2.3 million. which is 4.6% of the portfolio. The investment volume reached 1.6 billion USD

At the time of writing this article, the market capitalisation of Apple Inc. was above 2.3 trillion USD. The investments made by hedge funds for 55.5 billion USD constitute about 2.3% of this sum. This volume will hardly influence the company's stock price.

Moreover, the average trade volume of its shares in Q4 was about 74 million, which was 10.3 billion USD when the article was written. If we keep in mind that over that time hedge funds sold Apple stocks for 35.3 billion USD, the net volume of the purchase amounts to just 20.2 billion USD. This is the turnover these stocks reach over two trading sessions.

From October to December, Apple stock was trading without any obvious trend: In the beginning of the quarter, the quotes dropped to 134 USD, then rose to 157 USD. By the end of the reporting period, the stock price had dropped to 128 USD, demonstrating a return of -9.3%.

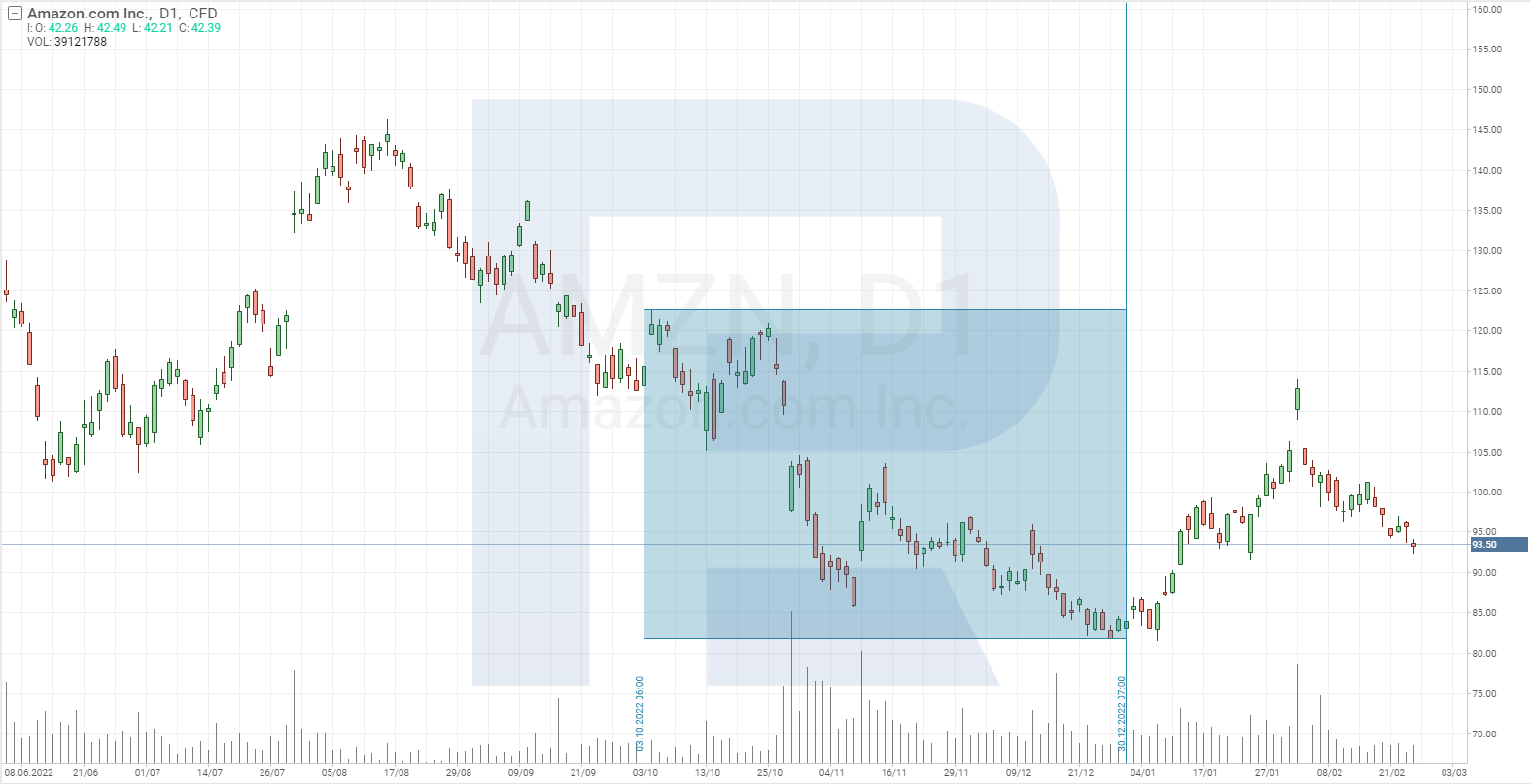

3. Amazon.com – 41.6 billion USD

Amazon.com Inc. (NASDAQ:AMZN) is a US multifaceted tech corporation, one of the world’s largest companies in terms of market capitalisation and income. Its main business is electronic commerce, Cloud computations and development, and sales of electronic devices and the streaming services Amazon Prime Video and Amazon Music.

In Q4, hedge funds invested 41.6 billion USD in Amazon stock. Here below are the largest investors:

- Norges Bank has been investing in Jeff Bezos’s company since 2013. Last quarter, it spent 8.2 billion USD on Amazon stock, increasing its number in the portfolio from 4.2 million to 98.3 million shares. Amazon’s proportion in the portfolio reached 2%.

- Morgan Stanley has also been investing in this tech company since 2013. From October to December, the fund bought 20.7 million Amazon shares for 1.7 billion USD, bringing their number in the portfolio to 141 million securities.

- JPMorgan Chase & Co (NYSE:JPM) has been investing in the corporation since 2013 too. The sum invested last quarter amounted to some 1.1 billion USD: 14 million shares were bought, which made the total number of shares in the portfolio reach 114.5 million, or the equivalent of 1.1%.

Amazon.com shares were purchased by many hedge funds in 2022, most probably because of the stock split that the company carried out in June 2022. As a result of the split at a 1:20 ratio, the stock price dropped from 2,400 USD to 122 USD. This means that for 1 million USD the hedge funds could buy 8.2 million shares instead of 410 thousand.

Over Q4 2022, the stock price of Amazon.com recorded a 26% decline, falling from 113 to 82 USD. This decline can possibly be explained by the fact that hedge funds sold some 36.6 billion USD worth of stock at this time.

Summary

As we can see, hedge funds dedicated most of their cash flows in Q4 2022 to the stocks of the largest companies in terms of market capitalisation. The Top 3 list of companies that were heavily invested in during the period of October to December features Microsoft Corporation, Apple Inc., and Amazon.com Inc. Hedge funds invested in these companies 58.9 billion, 55.5 billion, and 41.6 billion USD, respectively. Note that Norges Bank and Morgan Stanley bought shares of all three companies above.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high