Top Gaining Stocks of August 2023

6 minutes for reading

Telephone and Data Systems Inc., Apellis Pharmaceuticals Inc., Vertiv Holdings Co, Capri Holdings Ltd., and Applovin Corp. were among the top five growth stocks in August. Let us find out what has affected these companies' stock value.

Selection criteria for companies:

- The stock is traded on the NYSE and NASDAQ

- The share price exceeds 2 USD

- The companies are not classified as funds

- Their market capitalisation is over 2 billion USD

- Their average trading volume for the last 30 days exceeds 750,000 shares

Growth values were determined as the percentage difference between the opening prices on 1 August and the closing prices on 31 August 2023. The market capitalisation of the companies was valid as of the time of writing, namely 6 September.

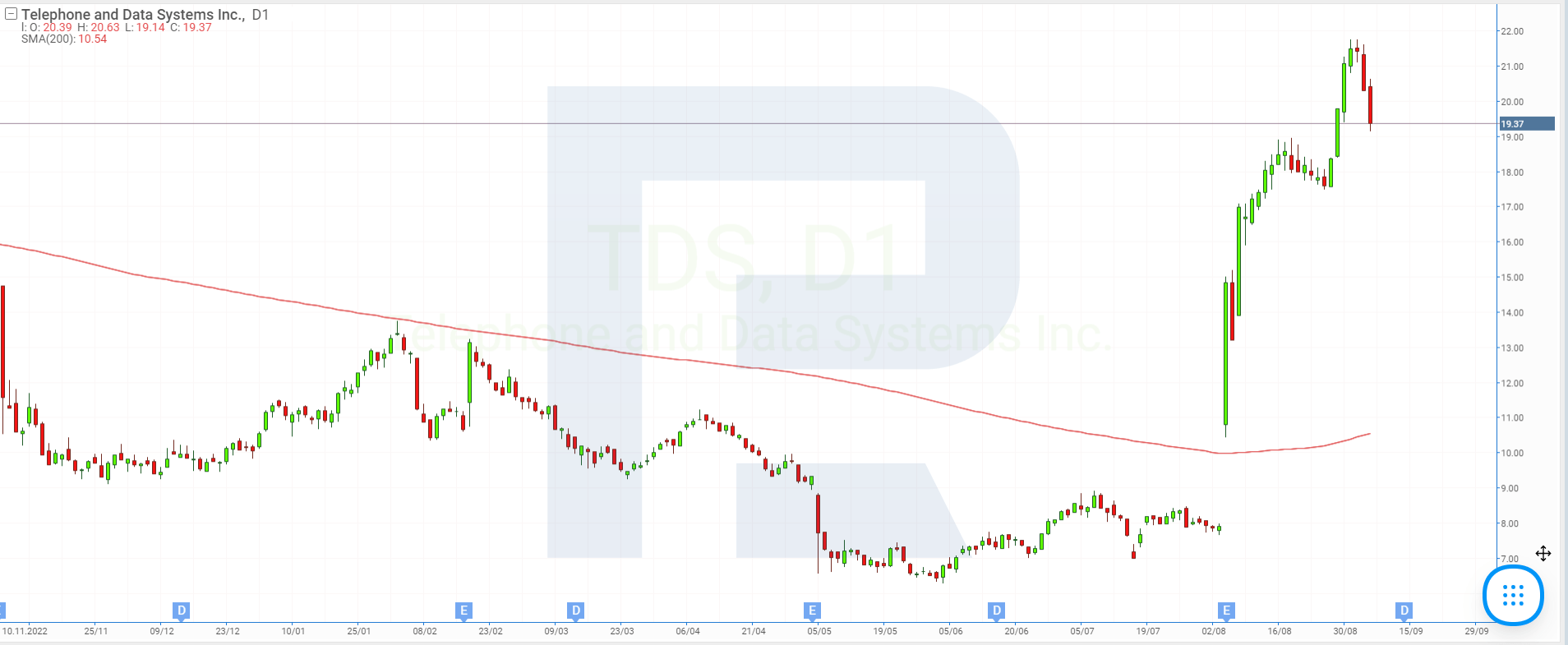

1. Telephone and Data Systems: +167%

Founded in: 1968

Registered in: the US

Headquarters: Chicago, Illinois

Sector: communication services

Platform: NYSE

Market capitalisation: 2.15 billion USD

Telephone and Data Systems Inc. consists of two lines of business: mobile communications and telephone, and Internet and IT services. UScell oversees the first line of business, while TDS Telecommunication LLC is responsible for the second. Telephone and Data Systems Inc. (NYSE: TDS) stock skyrocketed 166.96% in August, rising from 8.05 USD to 21.49 USD per unit.

Telephone and Data Systems Inc. reported its Q2 2023 results on 4 August. Operating revenues for April to June decreased by 6.08% from the corresponding period of 2022, dropping to 1.27 billion USD. Net loss amounted to 19 million USD or 0.17 USD per share while in the previous year, the company posted a net profit of 18 million USD or 0.15 USD per share.

2. Apellis Pharmaceuticals: +66%

Founded in: 2009

Registered in: the US

Headquarters: Waltham, Massachusetts

Sector: healthcare

Platform: NASDAQ

Market capitalisation: 4.93 billion USD

The stock of Apellis Pharmaceuticals Inc. (NASDAQ: APLS), which develops medicines for the treatment of autoimmune and inflammatory diseases, added 66.44% over the past month, surging from 25.36 USD to 42.21 USD per unit.

Apellis Pharmaceuticals Inc. released its Q2 2023 report on 31 July, reporting revenue growth of 481.85%, up to 94.97 million USD and a 21.76% decrease in net loss, down to 122.04 million USD or 1.02 USD per share.

In addition, on 22 August, Apellis Pharmaceuticals Inc. provided an update on the safe use of SYFOVRE®. In brief, the corporation suggests that rare cases of retinal vasculitis following injections of SYFOVRE ® may have occurred due to the use of 19-gauge filter needles. Therefore, Apellis Pharmaceuticals Inc. strongly recommends that only 18-gauge filter needles be used for injections of this drug.

On 29 August, Apellis Pharmaceuticals Inc. announced restructuring and its plans to lay off 25% of its workforce. Management expects this decision will result in cost savings of 300 million USD by 2024.

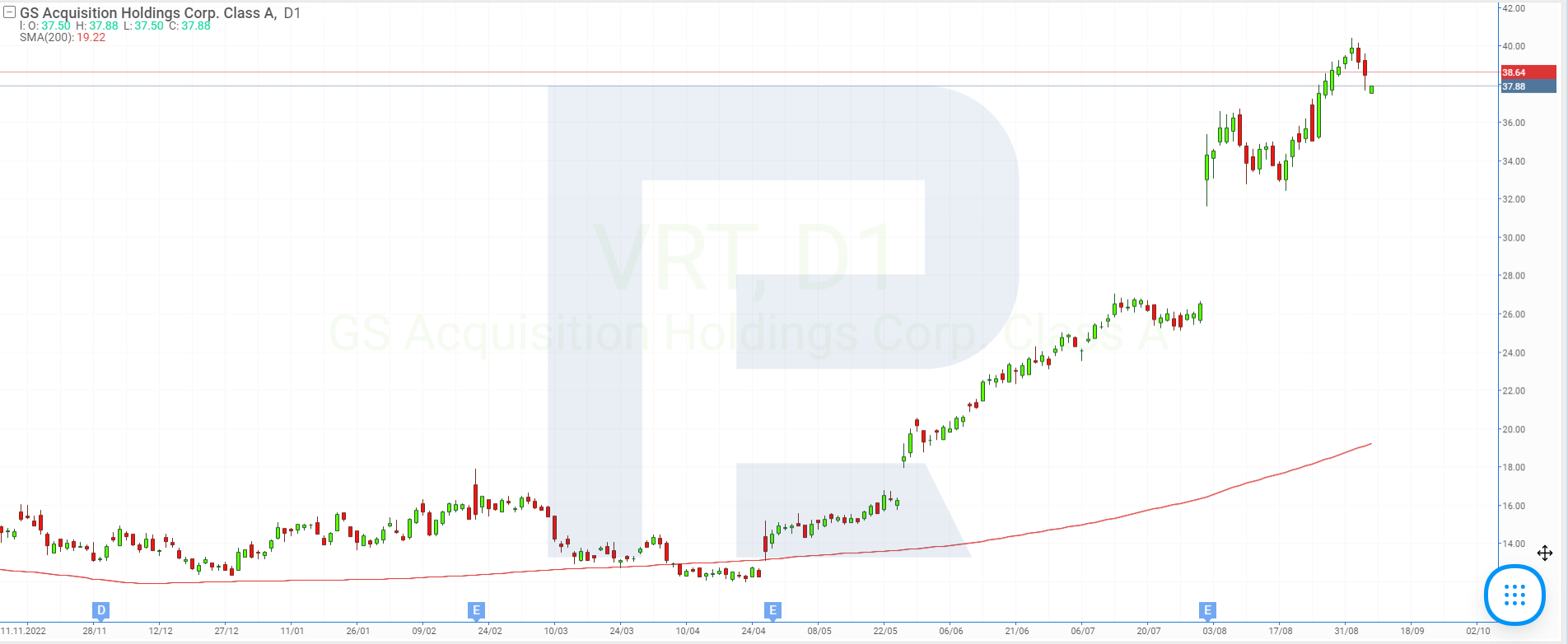

3. Vertiv Holdings: +53%

Founded in: 1946

Registered in: the US

Headquarters: Westerville, Ohio

Sector: industrials

Platform: NYSE

Market capitalisation: 14.71 billion USD

Vertiv Holdings Co develops, manufactures, and services hardware and software for digital infrastructure, data centres, communication networks, and commercial and industrial facilities.

Vertiv Holdings Co (NYSE: VRT) shares jumped 53.45% in August, rising from 25.67 USD to 39.39 USD. At the beginning of the month, the company announced its Q2 2023 results. Revenue for April to June increased by 23.92%, up to 1.73 billion USD, and net profit skyrocketed 309.85%, up to 83.2 million USD or 0.22 USD per share. Vertiv Holdings Co forecasts Q3 revenue to be in the range of 1.7-1.8 billion USD and full-year 2023 revenue to be 6.71-6.91 billion USD.

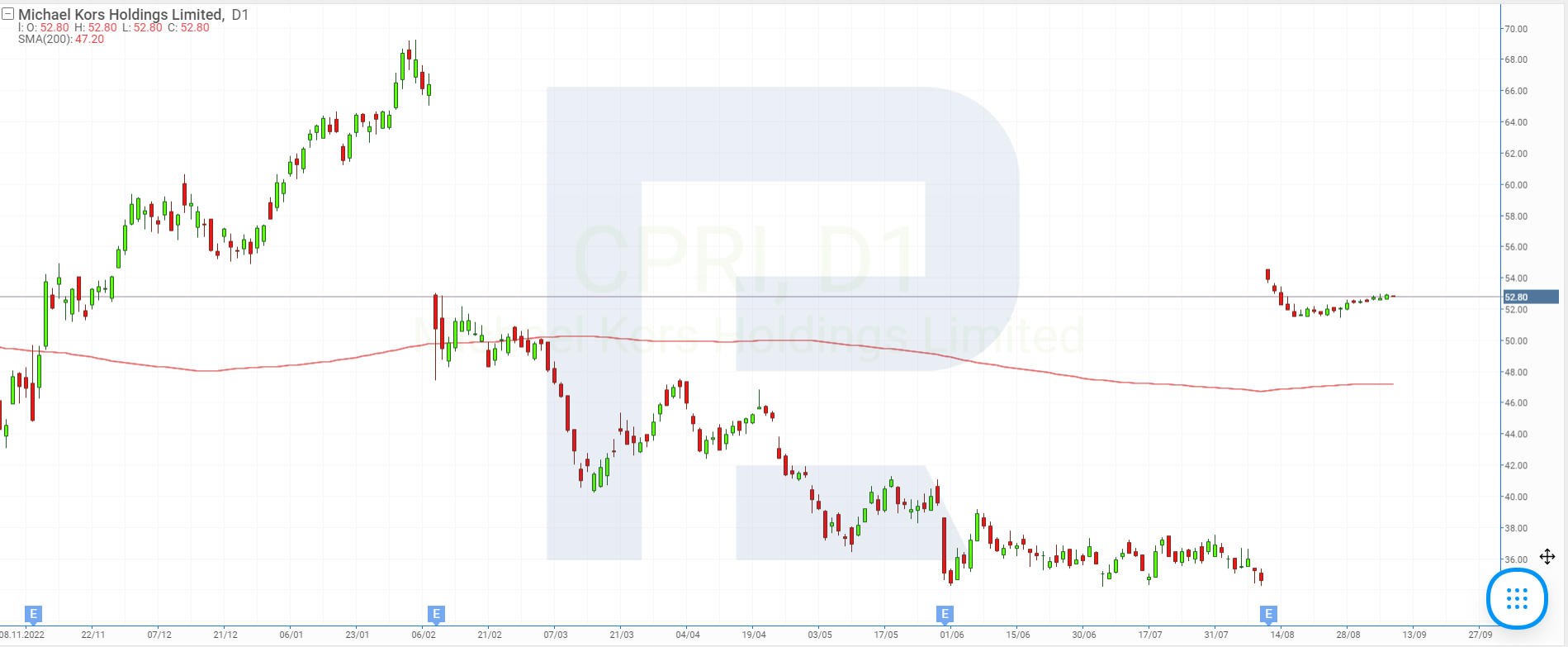

4. Capri Holdings: +43%

Founded in: 1981

Registered in: the US

Headquarters: New York, New York

Sector: consumer cyclical

Platform: NYSE

Market capitalisation: 6.09 billion USD

Capri Holdings Ltd. designs, produces, and markets luxury women's and men’s wear, footwear, and accessories. It owns fashion brands such as Michael Kors, Jimmy Choo, and Versace. Capri Holdings Ltd. (NYSE: CPRI) stock increased by 43.1% in August, rising from 36.68 USD to 52.49 USD per unit.

Capri Holdings Ltd. released its Q1 fiscal 2024 report on 10 August. Revenue for April to June decreased by 9.63%, down to 1.23 billion USD, and net profit plummeted by 76.35%, down to 48 million USD or 0.41 USD per share.

On the same day, the company published a press release on its website, stating that Capri Holdings Ltd. would be acquired by Tapestry Inc., which owns such brands as Coach, Kate Spade, and Stuart Weitzman. The deal value is 8.5 billion USD. The total revenue of these holdings for the previous financial year exceeded 12 billion USD with the adjusted operating profit reaching nearly 2 billion USD.

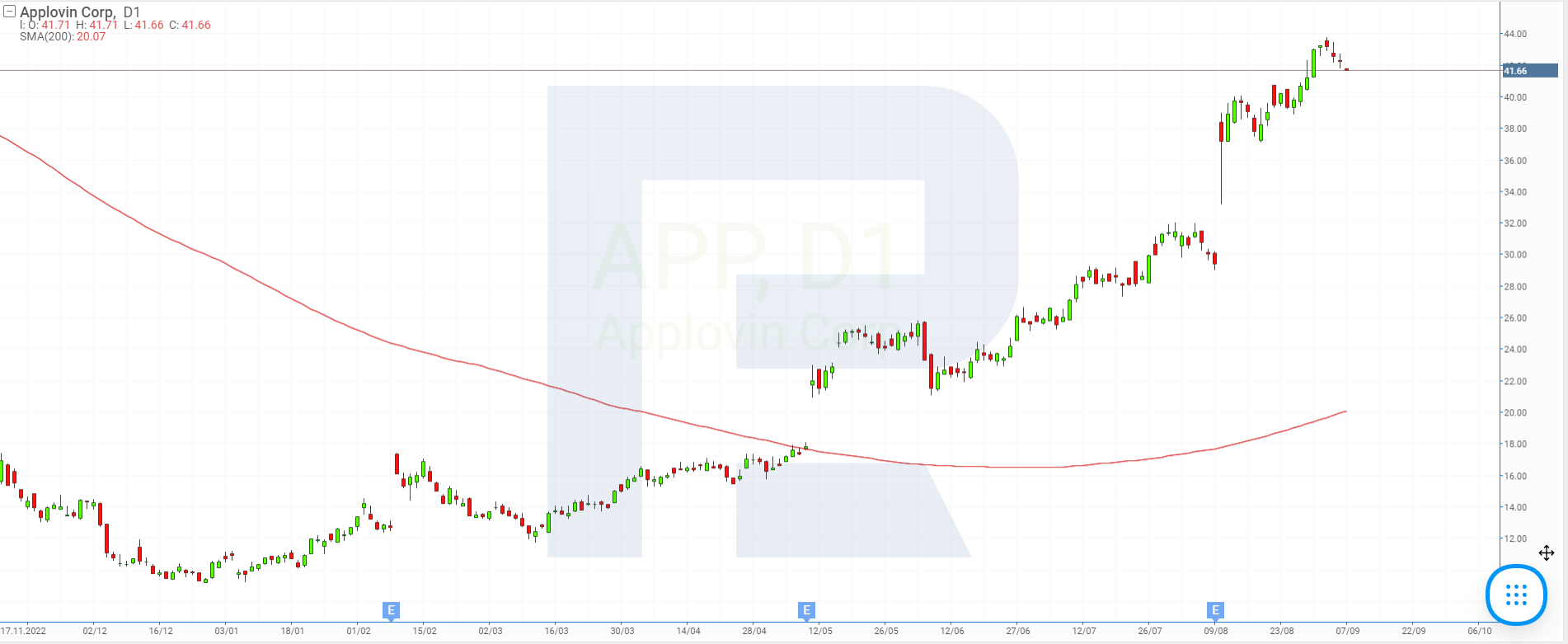

5. Applovin: +39%

Founded in: 2011

Registered in: the US

Headquarters: Palo Alto, California

Sector: technology

Platform: NASDAQ

Market capitalisation: 14.70 billion USD

Applovin Corp. provides mobile app developers with comprehensive software solutions based on AI technology. The products help perform more detailed data analysis, improve marketing strategy, optimise monetisation and sales of digital advertising, and most importantly increase profitability of projects.

Applovin Corp. (NASDAQ: APP) stock gained 38.79% in August, rising from 31.14 USD to 43.22 USD per share. The company released its Q2 2023 report on 9 August, reporting a 3.36% decrease in revenue for April to June, down to 750.17 million USD.

Net profit reached 80.36 million USD or 0.22 USD per share while a year ago, the company posted a net loss of 21.75 million USD or 0.06 USD per share. Applovin Corp. expects Q3 2023 revenue to reach 780-800 million USD.

Top stocks with prominent dynamics in August

The leaders of stock price gains in August were Telephone and Data Systems Inc., Apellis Pharmaceuticals Inc., Vertiv Holdings Co, Capri Holdings Ltd., and Applovin Corp. In most cases, the primary driver behind the surge in the stocks of these companies was the release of their respective quarterly earnings reports. Additional individual factors include deals with other large corporations, as well as news of restructuring and layoffs. It is also worth noting that all the companies on this top list represent different sectors of the economy.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high