Profitability in 2022: Leaders and Outsiders

5 minutes for reading

Today we will find out which sectors of the economy and which of their representatives demonstrated the highest and lowest profitability in 2022. Let's try to explain the reasons for such growth and decline.

What events preceded 2022

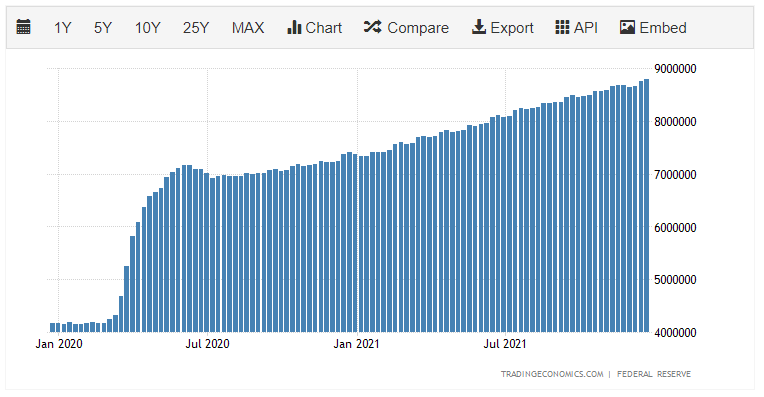

With the breakout of the COVID-19 pandemic in 2020, the US government initiated the QE programme, pouring trillions of dollars into the country's economy. If we take a look at the balance chart of the CB that was providing businesses with cash buying corporate bonds, we will notice a recorded growth of more than 4.5 trillion USD from April 2020 to December 2021.

Over this period, the S&P 500 stock index saw a 115% growth, while the number of companies that entered exchange platforms set a record, reaching 1504.

Reduced investments in oil

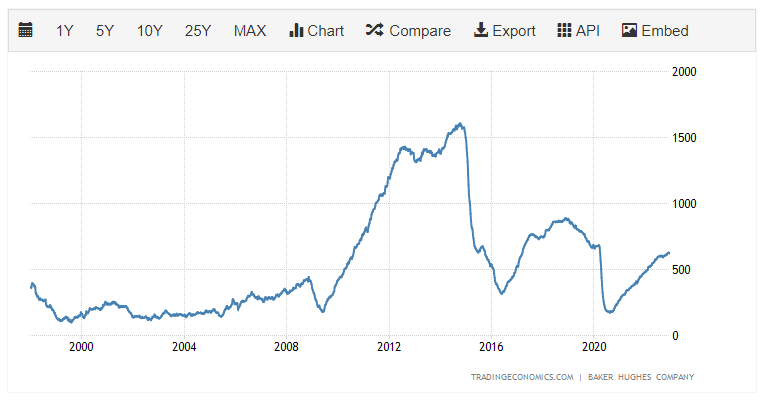

With most of the money spent on developing environmentally friendly energy sources, the oil sector financing was reduced. Consequently, the number of oil drills reached a 15-year low in the US.

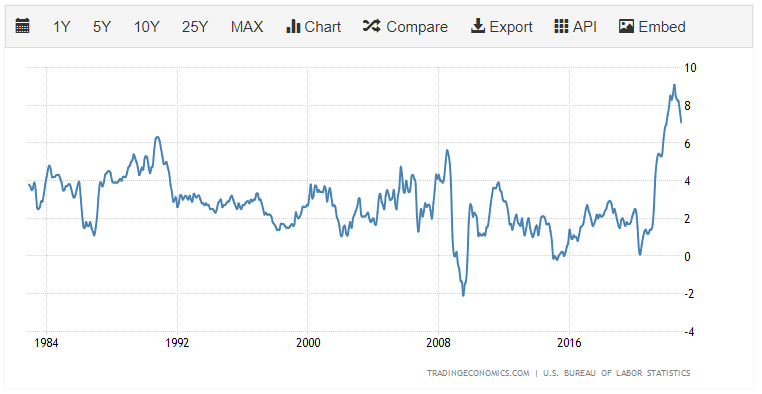

Record inflation

The launch of the QE programme caused a sharp increase in the demand for goods. And with oil products not just being the crude material for production, but also the main fuel for transportation, the demand for crude oil increased considerably, and so did oil prices. Moreover, other commodities became more expensive. All this led to the rise of inflation, which by July 2022 had recorded a 0.1% growth, reaching a level of 9.1%, a new 40-year high.

To keep the situation under control, the Fed started a cycle of interest rate hikes and launched the QT programme. 2022 turned out to be the total opposite of 2020 and 2021, with almost no catalysts for the growth of stock prices.

Top-3 yielding sectors in 2022

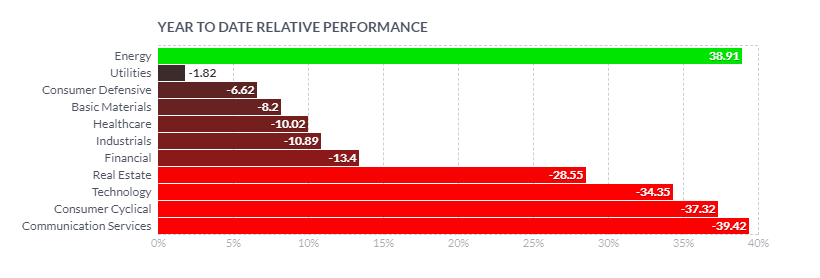

The only sector of the economy that demonstrated profitability this year was the energy sector – thanks to hydrocarbon prices hitting all-time highs. The return of the sector was 38.91%, making it number one in our rating.

Number two is Utilities: return here reached -1.82%. Number three is the Consumer defensive sector with -6.62% in return. The worst yield was demonstrated by Communication services: it amounted to -39.42%.

Energy sector

The Top 3 leaders of the energy sector with capitalisation over 10 billion USD are:

- Occidental Petroleum Corporation (NYSE: OXY): +113%

- Texas Pacific Land Corporation (NYSE: TPL): +99%

- Hess Corporation (NYSE: HES): +82%

All the companies above specialise in the exploration, mining, transportation, and sales of oil and gas.

Utilities

The Top 3 leaders of profitability in Utilities are:

- Constellation Energy Corporation (NASDAQ: CEG): +107%

- Centrais Eletricas Brasileiras S.A. (NYSE: EBR): +35%

- PG&E Corporation (NYSE: PCG): +31%

All three companies sell electric energy to consumers, which in 2022 became significantly more expensive due to the rising gas prices in Europe and the US. Note that the members of the Top 3 list get electric energy not only from hydrocarbons and nuclear materials but also from renewable sources. Because of the unprecedented growth of gas prices, the primary cost of renewable energy sources became lower than the primary cost of energy received from hydrocarbons.

Consumer defensive sector

The Top 3 companies with the highest profitability in the sector include:

- Lamb Weston Holdings Inc. (NYSE: LW): +39%

- Archer-Daniels-Midland Company (NYSE: ADM): +38%

- Campbell Soup Company (NYSE: CPB): +30%

These companies specialise in the production and sales of foods.

Communication services

The worst profitability in the sector was demonstrated by:

- Roblox Corporation (NASDAQ: RBLX): −74%

- Meta Platforms Inc. (NASDAQ: META): −65%

- Zoom Video Communications Inc. (NASDAQ: ZM): −64%

- Netflix Inc. (NASDAQ: NFLX): −50%

- The Walt Disney Company (NYSE: DIS): −44%

- Alphabet Inc. (NASDAQ: GOOG): −39%

Companies with the maximum yield in 2022

Among the companies traded on US exchanges with a market capitalisation of over 2 billion USD, the Top 3 list comprises:

- Scorpio Tankers Inc. (NYSE: STNG): +322%

- TORM plc (NASDAQ: TRMD): +273%

- CONSOL Energy Inc. (NYSE: CEIX): +216%

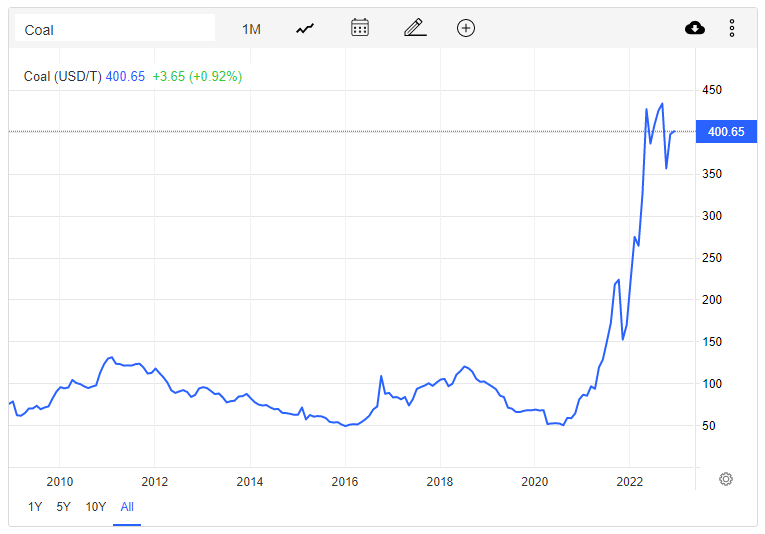

Scorpio Tankers and TORM specialise in the worldwide transportation of oil products. CONSOL Energy mines, processes, and sells bituminous coal to electric companies, and industrial and metallurgic enterprises. Note that in 2020-2022 coal prices skyrocketed by 700%.

Companies with the minimum profitability in 2022

- Affirm Holdings Inc. (NASDAQ: AFRM): −90%

- AppLovin Corporation (NASDAQ: APP): −89%

Affirm Holdings provides payment solutions for stores. AppLovin works in mobile technologies. Over 2022, these issuers have generated no profit.

Summary

The Top 3 sectors in terms of profitability in 2022 include Energy, Utilities, and the Consumer defensive sector. The Energy sector is the only one with a positive return this year.

The Top 3 companies with the maximum profitability in 2022 are Scorpio Tankers Inc., TORM plc, and CONSOL Energy Inc. The Top 3 companies with the minimum profitability in 2022 are Affirm Holdings Inc., AppLovin Corporation.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high