IPO of Edible Garden: 21st Century Greenhouses

4 minutes for reading

Fresh fruit and vegetables are available throughout the year nowadays, and consumers seldom reflect on the fact that this is thanks to the development of greenhouse businesses and agricultural technologies.

Our today's article is dedicated to Edible Garden, a company engaged in the development of technologies for growing produce in greenhouses. On 4 May, Edible Garden AG Inc. is planning to go public by listing on the NASDAQ under the "EDBL" ticker symbol.

What we know about Edible Garden

Edible Garden AG Inc. is an agricultural company specialising in growing sustainable fruit and vegetables in an indoor environment. The company uses conventional agricultural methods combined with modern technologies.

This combination offers opportunities not only to grow fresh organic food in a sustainable way but also to improve the control system and business processes.

For example, to grow herbs and lettuce, Edible Garden uses a controlled environment of classic installations – glass greenhouses – along with hydroponic and vertical farms.

These methods help to grow plants in greenhouses without soil and to make effective use of indoor installation space. To maintain ecological balance, the company tries to avoid the depletion of natural resources. For example, some materials are recycled for further use.

The process of growing the fruit and vegetable produce is controlled by using the company's proprietary software solution named GreenThumb. Compared with conventional agriculture, Edible Garden's closed systems require much less soil, water, and energy.

This sustainable approach to agriculture ensures taking appropriate and reasonable care of our planetary resources. In addition, the use of cutting-edge technologies for growing plants reduces the risk of possible plant infestations by harmful pathogens.

What are the prospects of Edible Garden’s target market?

The traditional farming system in the US mainly consists of field farms. According to the U.S. Department of Agriculture, in 2019, there were almost 900 million acres of farmland.

In the past few decades, small agricultural households combined into large-scale farms. Nowadays, family lands in the US amount only to 3% of the farms and 42% of the total output, which has a well-defined regional structure.

According to the American Farm Bureau Federation, Monterey County in California provides the US market with 61% of leaf lettuce and 56% of cabbage lettuce produce.

This regional dependence leads to creating long and complicated distribution chains. Consequently, some products have to travel for several days, covering thousands of miles until they finally hit store shelves.

Taking into consideration ecological and social-macro tendencies, Edible Garden experts came to the conclusion that conventional crop growing is not suited enough to meet the requirements of the planet's increasing population. The reason for this is the high dependency on land, water, and other natural resources, which are becoming more and more scarce, making them insufficient for the manufacturing of food products.

How Edible Garden performs financially

At the time of the IPO, the issuer had not generated any net profit, which is understandable for young companies at their early stage of development. We will therefore analyse Edible Garden's financial performance with its revenue.

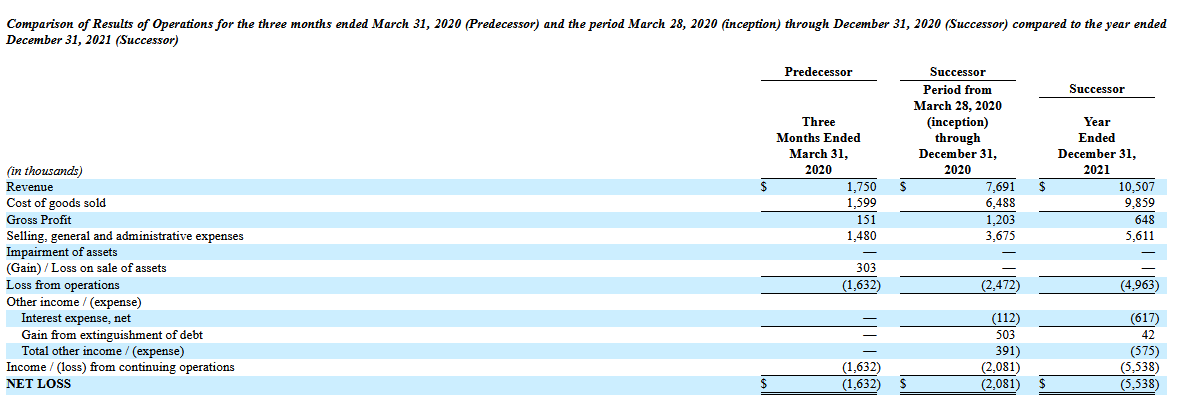

In 2021, the company's sales were $10.51 million, representing an 11.33% increase in comparison with 2020. Although this growth may not seem impressive, admittedly, the probability for more could not be possible bearing in mind that the company has only just started building its client base. Edible Garden says that there is every expectation that an average check and the total sales figures might increase in the nearest future.

The issuer's net loss in 2021 was $5.54 million – this is a 49.33% increase in comparison with 2020. As of 31 December 2021, Edible Garden's total liabilities were $2.2 million, and the cash equivalents on its balance sheet were $14.41 million.

Strengths and weaknesses of Edible Garden

The company's strengths are:

- High growth rate in the number of new clients

- The company is investing in product development

- Strategic development plan

- Prospective target market

- Proprietary patented software

The list of weaknesses is much shorter: low revenue and no net profits.

What we know about the Edible Garden IPO

The underwriters of the IPO are Maxim Group LLC and Joseph Gunnar & Co. LLC. The issuer is planning to sell 1.39 million American depositary shares (ADS) at the price of $7.22 per share. The IPO volume might be about $14.98 million. If the IPO is a success, the company's capitalisation might be about $78 million.

Since the company doesn't generate net profit, to assess its prospects we use a multiplier – the Price-to-Sales ratio (P/S ratio). The issuer's P/S value is 7.6, which means that buying Edible Garden shares is a classic venture investment unless the revenue growth increases. This is why one should not invest more than 1% of the portfolio in this IPO to mitigate the risks involved.

* – Past performance is not a reliable indicator of future results or future performance.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

are complex instruments and come with a high

are complex instruments and come with a high  of losing

of losing  rapidly due to

rapidly due to  . 65.68% of retail investor accounts lose

. 65.68% of retail investor accounts lose  when trading

when trading  with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high

with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high